FormPiper Case Study

The Puppy Store & cedar pet supply

What makes for a strong consumer finance program? It always starts with the customer relationship.

Richard Pena had a problem. As the Vice President of Operations for David Salinas’ chain of pet stores, operated under two brands – The Puppy Store in Nevada and Utah and Cedar Pet Supply in Utah – Richard has a busy schedule. That means he doesn’t have a lot of time to devote to managing the more manual processes that come with the standard consumer financing program. At the same time, he understands the immense importance of offering consumer financing to the customers he serves.

“It’s a matter of convenience for them,” says Richard. “They don’t have to come up with these huge amounts. They can, you know, work on a smaller payment that fits a budget.”

Whether purchasing a new pet or buying supplies for their favorite furry friend,

Richard’s pet shop customers appreciate consumer financing not only because it helps them bridge financial gaps, but also because it simply provides them with a greater level of flexibility.

Unfortunately, the convenience and flexibility of consumer financing is often erased by the difficulties associated with the finance application process. Not only does a cumbersome application process slow things down for the customer, it also presents a serious inconvenience for the retail business team inputting the consumer applications.

What was this outdated application process like for Richard and team?

As Richard puts it, “You had to manually input each one. If there were five finance companies, for example, you had to sit there and fill out applications for each one of them, which was time consuming.”

Dealing with a slow, laborious application process can be frustrating, to say the least. Fortunately, David Salinas discovered FormPiper – and Richard took full advantage of its capabilities in streamlining the consumer finance application process.

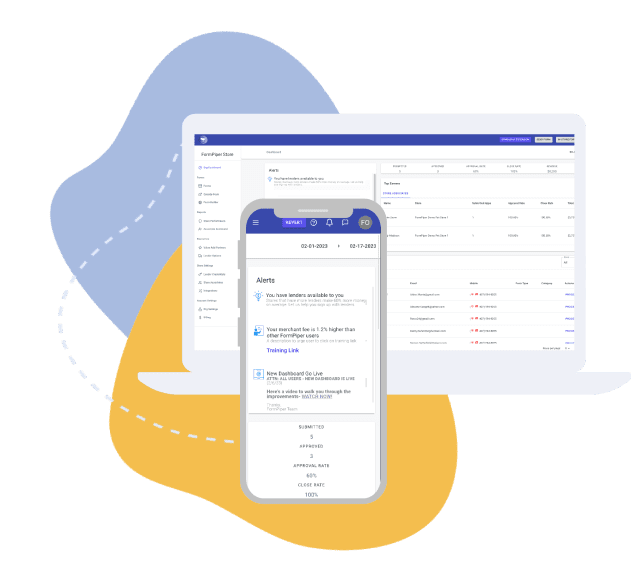

By automating the filling of multiple application forms at once with a single click, FormPiper takes what was a difficult process causing frustration for the customer and retail employee alike into a total breeze. How big of a difference did Richard see with FormPiper?

“It’s like night and day,” says Richard. “I mean, you fill out one application and from there, you're able to apply to various companies or as many companies as needed. (…) You don't have to spend the next five minutes applying on a different application. You’re just all done, ready to go – kind of a one-stop-shop."

In addition to enjoying a streamlined application process, Richard and team took full advantage of FormPiper’s reporting capabilities. Specifically, Richard leveraged the Associate Scorecard, which shows critical data on employee consumer finance performance through one convenient dashboard.

“We're able to monitor the productivity of our employees. We can see, you know, who's actually processing the applications or who never does, you know, or the differences between the two. And I think that just helps us monitor in the company, who's the more productive salesperson.”

But what about other retail businesses? Can they use FormPiper to improve their consumer finance program from top to bottom in a similar way?

If you ask Richard, the answer is a resounding ‘yes.’ “If they’re going to use multiple finance companies, it’s common sense to use a company like FormPiper to make your processing systems a lot faster,” says Richard.

That’s the FormPiper difference in action. Like Richard said, FormPiper delivers a night and day distinction for retail businesses looking to take their consumer finance programs up a notch.

From streamlining the application process to making it easier than ever to monitor and coach sales team members, FormPiper is a great choice for any retail business that offers financing to its customers. It’s made a big difference for Richard Pena’s business, and it can make a big difference for yours.

Want to see for yourself why Richard and other customers are so happy with the FormPiper solution? Schedule a demo today.