Put your financing programs in the fast lane and frustrations aside

Streamline your process to run 76% more applications, resulting in more approvals and happier customers.

3 Steps to processing finance applications 95% faster

1 | Eliminate duplicate data entry

Conventional Process

With each rejected application, another form has to be filled out, and the customer and sales associate become more frustrated.

The FormPiper Process

Your customer fills out a single finance application - either via your website or in-store using a store device or their mobile phone.

2 | Automatically open browser tabs for each lender

Conventional Process

The sales associate manually processes applications with each lender one-by-one, growing increasingly concerned about the time they’re spending that may not result in a sale or a commission.

The FormPiper Process

Your sales associate or managed services processor selects the most appropriate options from your preferred range of prime, near-prime, sub-prime and no-credit-check lenders and pushes ‘go’.

3 | Ensure all financing options are considered

Conventional Process

Your customer becomes increasingly embarrassed and walks out, never to return again. Meanwhile, your sales associate vows never to spend time on credit-challenged customers.

The FormPiper Process

With each application already pre-populated, each one is submitted until you get the approval needed to close the sale.

Business Impact

What can your business expect by using FormPiper?

Process More

Increase processed finance applications by 76%

Process Faster

Process finance applications 95% faster

Grow Revenue

Grow revenue and get 20% more financed sales

Customer Satisfaction

Create a seamless and positive customer experience

Better Marketing

Extract more value from marketing and advertising initiatives

Case Studies

Proven results with FormPiper

Here’s how we’ve already helped lenders.

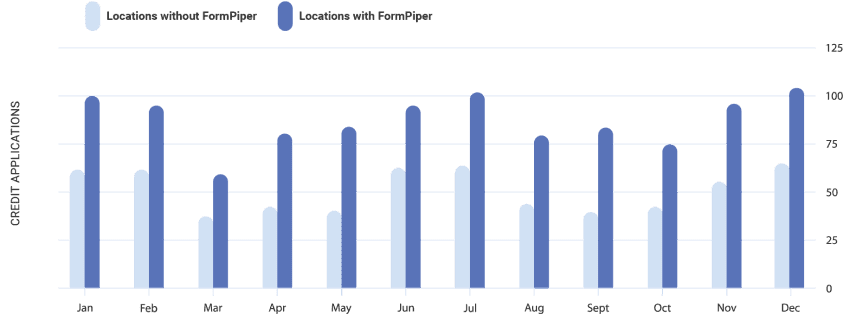

Case study 01

76% more retail finance applications with FormPiper

Data gathered across 180 locations from 2019-2020

*Please note that because of a non-disclosure agreement, we cannot share the name or industry of this case study.

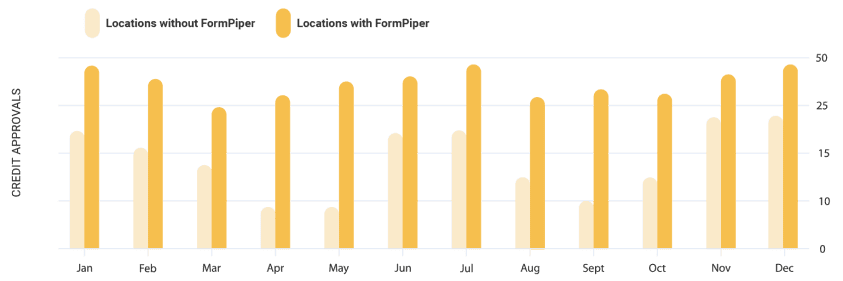

Case study 02

135% more retail finance approvals with FormPiper

Data gathered across 180 locations from 2019-2020

*Please note that because of a non-disclosure agreement, we cannot share the name or industry of this case study.

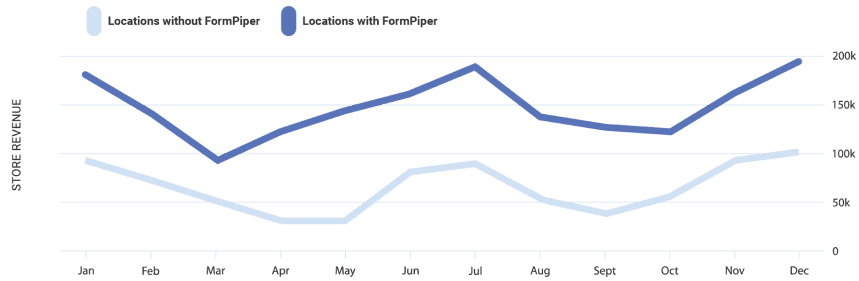

Case study 03

125% more retail store revenue with FormPiper

Data gathered across 180 locations from 2019-2020

*Please note that because of a non-disclosure agreement, we cannot share the name or industry of this case study.

We serve organizations of all sizes

From single store locations or large buying groups. We have the right product and support for you.

Single Locations

Multi Locations

Franchise Groups

Corporations

Buying Groups

Options to get started

There are two primary offerings, depending on the level of service you desire.

Option 1: Managed Services

Customer financing has never been simpler and more convenient. We complete the entire financing process, from application to funding.

Option 2: Self-Managed

Keep the financing process in-house. You work with your customers to complete applications and contracts.